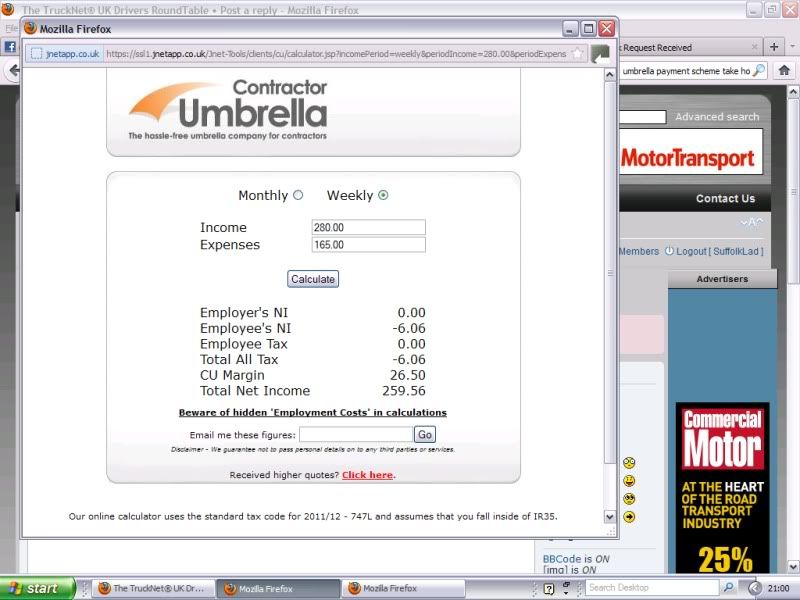

Right, I’ve been to see an agency today, with a view to starting work for them in the next couple of weeks. They’ve suggested I go through an umbrella payment scheme, but is it worth it? I’ve had a look on the company (their suggestion) and put some figures into their calculator, and I honestly can’t see that its worth it.

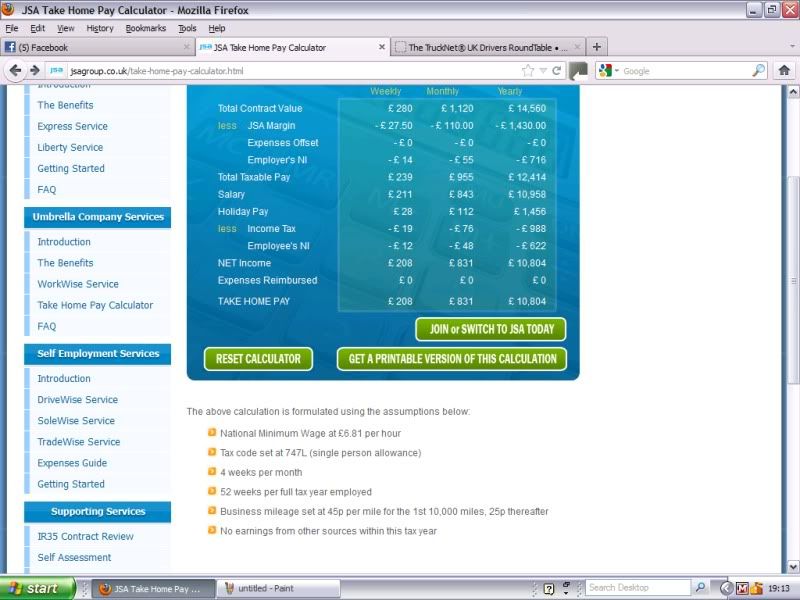

The work is C1 working for the NHS, £7 p/h, 8hrs a day, travelling to work and back, the mileage works out at 300mls per week, at an allowance of 45p per mile, and meal allowance at £7 per day. After putting the figures into their calculator, with their fee of roughly 10%, the take home pay on a basic 40hr week, isn’t (to me anyway) too good. There is no mention of any expenses reimbursed or offset, with the take home being £208, does this sound correct?

Anyway, a screenshot of the calculations…

The bit I dont understand is the expenses, its 30mls to work and then same again home, going to be a good £10 fuel a day, yet no mention in the calculations of any reimbursement, or offset or is that not how it works? Can anyone explain how it works, am I reading it wrong?