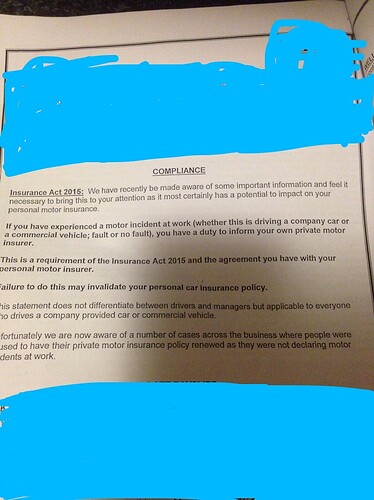

So I’ve seen this vaguely discussed before on here. First time I’ve ever seen a company warn it’s drivers about it though. Insurance companies clamping down?

Yes, you are supposed to declare it. I had a minor bump in my truck and I did inform my car insurance company but it didn’t affect my premium.

was that a morris minor

hotel magnum:

was that a morris minor

Or Arthur Scargill

You will always be asked if youve had an accident/ claim in the last 5 years whether your fault or non fault. The answer will be yes, it makes no difference whose insurance youre covered on. This is nothing new its always been this way…

AndrewG:

You will always be asked if youve had an accident/ claim in the last 5 years whether your fault or non fault. The answer will be yes, it makes no difference whose insurance youre covered on. This is nothing new its always been this way…

It says the act was brought in last year ![]()

HAHAHAHAHA! ■■■■ that!

So is the reciprocal true? If you have a claim outside of work should you declare it to your employer?

scanny77:

AndrewG:

You will always be asked if youve had an accident/ claim in the last 5 years whether your fault or non fault. The answer will be yes, it makes no difference whose insurance youre covered on. This is nothing new its always been this way…It says the act was brought in last year

It’s always an interesting question this. It also seems to provoke strong feelings, not to mention commandments about how people should behave, which are often not grounded in any law of the land.

The Insurance Act 2015 does not, as far as I can tell, change the position with regard to personal insurance policies, but applies only to commercial insurance policies.

The major update of the law, as regards consumer insurance, is the Consumer Insurance (Disclosure and Representations) Act 2012, which predates the Insurance Act 2015.

The effect of both acts has been to abolish “utmost good faith”. In consumer policies, the requirement is now to honestly and carefully answer the questions asked by the insurer. The law itself is further modified by the jurisdiction of the Financial Ombudsman, who can adjudicate in the interests of fairness, good business practice, and the reputation of the marketplace (as against what might be seen as legal technicalities).

By way of illustration, if you break your foot in a tail lift at work, that can certainly be cast as an accident, and one involving a motor vehicle too.

When a person buys a personal car policy (and that context is important), and is asked “have you had any accidents?”, does that question clearly and specifically relate to the foot-breaking accident at work? I would say there is not a clear and specific connection between the question in that context and the fact.

And as Harry Monk also points out, even actual collisions are not considered material where they fall into what he describes as a “minor bump”, and a consumer cannot be penalised by failing to disclose what is irrelevant anyway.

A further point I would make is that, as regards consumer insurance, there only appears to be a duty to answer a question if and when an insurer asks it. There isn’t a legal requirement to disclose new facts which occur or become known during the currency of an existing policy - which I think is what the implication usually is, as with the OP’s company memorandum, when people say “you need to tell your insurer”, they don’t mean you need to tell them next year when they ask, they mean you should go home and tell them that evening (which isn’t required).