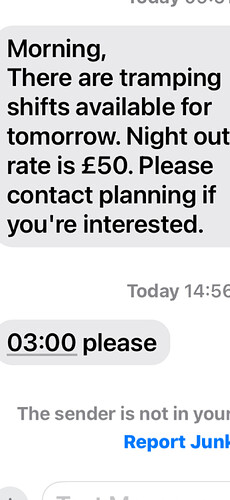

Don’t worry I’m not going tramping , I’m just intrested in did night out money go up post brexit like wages did .

My memory was it was around the £25-£30 mark pre brexit for most , I’m just intrested in did it go post brexit , if so how much , what’s the average now

Ta

I haven’t done tramping for 2 years now but was always £25 a night. Which didn’t go far back then get even less these days.

By time bought a breakfast nice meal at night

Good thing about where I worked was given £100 cash night out money every friday.

Someone may prove me wrong but sure it’s £25 as that’s most you can claim tax free anything more HMRC get involved want receipts n stuff

Thanks edd , I’ve not tramped for 4 + years at a guess so I thought maybe night out money had risen a lot since brexit , but it seems it’s more a case they can’t get trampers so there paying a few more £££ to try to attract volunteers .

Fifty quid is IMO exceptional. That’s the sort of territory of blue chip companies such as BOC etc, the most I’ve ever had is £30 per night.

Still 30 quid where I am. But I started for the firm after Brexit. Also I think they do it 25 quid and 5 pounds expenses (supposed to show a receipt but few do).

Could be week-end only and an absolute ■■■■-route with extra nonsense. Also that is from a company or agency? @ady

Sorry, you’ve lost me.

Brexit has improved night out money lol. I’m assuming its all tax free? I wouldn’t know not being a tramper.

Generally you can get £25 tax free per night out, with no receipts needed. Any payment above that may be taxed unless receipts are provided.

If the job offer is for £50 per N/O then you can probably expect £25 tax free and £25 taxed.

If doing a 5 day week always with 4 N/O, maybe think of it as 4 normal N/O plus £100 wages (£20 per day)

If it is a good job with good pay, then great, if it is a poor job, or is badly paid, then does the extra hundred quid per week make enough difference?

You lucky buggers getting 25 quid a night. Most big trucking companies here in the US don’t pay night out money. ![]()

We have to keep the receipts to prove we had a night out, as the taxman caught wind of drivers pretending to have a night out in the cab but were actually at home.

By receipts, that’s for buying food and drink on the road but there’s nothing stopping anyone going through the bins to get receipts then claim the night out money for being at home.

Last place i worked for tramping they started asking for recpiepts at one time. I said how supposed get recipiepts from local cafe butyy van etc.

Anyway I need up giving them receipts from pubs where had my tea .

from Tesco’s if bought pint milk whs smiths for a paper etc god knows what they made of it all

Govt tax free rate is somewhere around £27. If they’re paying £50 a night you’ll be paying tax and NI on it and not just the bit above the govt agreed tax free amount but the whole lot. So after tax and NI you’ll come out with around £36 as a basic rate tax payer.

A thought occurs…open to correction of course.

Because it is a payment related to expenses, it will not be counted in average pay for purposes of calculating holiday pay.

Although I suggested it could be thought of as approx £100 a week pay rise, it will be a bit less than that at year’s end.

Still £26.20 UK and £36.20 EU where I work. I think it’s been basically £25 wherever I have worked since 2008.

We get 40 a shift tax free. Paid separate from salary.

Night out money will never go up & hasn’t for as long as I can remember. Shows how much we are valued by the Government.