newmercman:

The thing is Rjan, there’s no one size fits all solution, you lean to the left, I lean to the right, one of is always going to be disappointed.

I think that whoever gets in makes no difference, as I said earlier, each successive government has increased taxes and cut services, expecting anything different from the next lot is the true definition of insanity. I.E. repeating an exercise without changing anything and expecting a different result.

The system is broken, broken beyond repair and a new system is necessary, until that happens we are just papering over the cracks.

The reason it has made no difference who you vote for in the recent past is because the last time we had a real Labour government elected was 1974 - when there was industrial uproar over Tory attacks on the unions and Ted Heath went back to the country to ask “who governs?” - and as me and Carryfast discuss to no end, Callaghan’s government was vexed with firefighting economic troubles and allegations of treachery. In New Labour you saw a continuation of Thatcherite economic policy, based on attacking workers’ share of the economic pie and letting inequality rip, but with a watered-down slop of left-wing social policy.

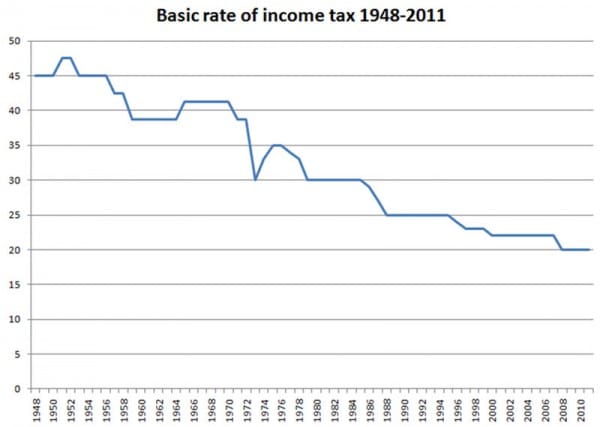

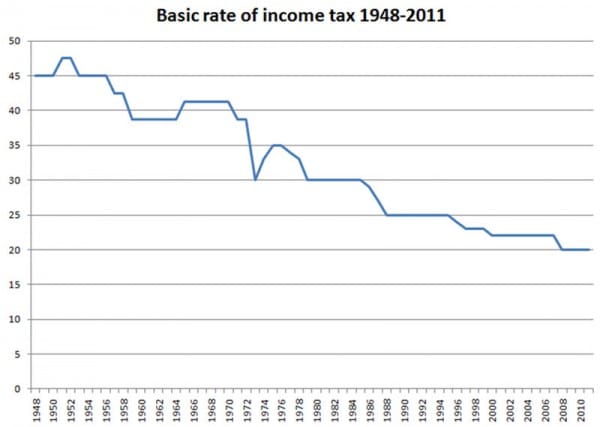

You say taxes have gone up, but of course that is not the truth at all:

So too the higher rates have dropped dramatically:

You can see that in the UK, the red line, the highest rates of income tax today are lower than they were in the 1930s. What has gone up is regressive sales taxes, a variety of fixed charges, rents, residential property prices, and all sorts of other taxes and costs that hit ordinary earners hardest.

And as for corporation tax:

And what this shows, incidentally, is that as CT rates have fallen, more and more wealth has been taken as corporate profits. The Blairites used to (and probably still do) argue that this meant revenue for the Exchequer was staying (mostly) steady, but of course it also means that personal revenue for the rich (via unearned income) is massively increasing (whilst personal revenue for the poor, via earnings, has stagnated).

So when you say “taxes have gone up”, you can see that it’s not true - what has happened is that the tax burden has been shifted from rich to poor, and so too income itself has shifted from earners through wages, to wealthy idlers through profits. Public services are going down because the rich are paying less and less tax, year after year, and because earners have smaller and smaller shares of the economic pie.